draftkings sportsbook tax form

Some are wondering if it is safe to submit your social security. To access the Document Center via mobile web.

Paying Tax On Your Sports Betting Profits Is Simple Kind Of

This is a follow up to something I posted yesterday about the fact that nobody at the restaurant I manage has received tax forms for 2021.

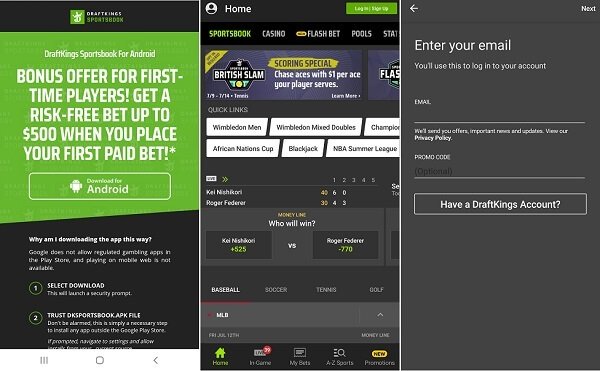

. DraftKings customers in the United States arent taxed on their withdrawals. Tap the three-line Menu icon in the top right corner. The CDC recently extended it until April 18 while also indicating it is.

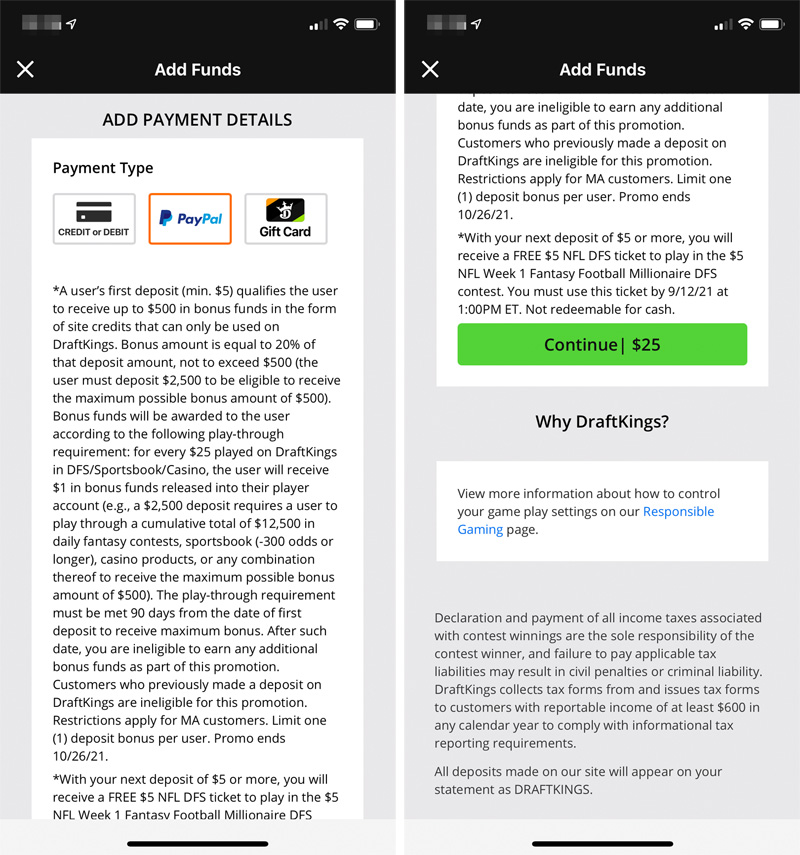

If you dont want to receive a physical tax form in the mail you can opt to receive electronic-only tax forms instead. A separate communication will be sent to players receiving tax forms once they are available for download in the DraftKings Document Center accessible via the DraftKings website. Key tax dates for DraftKings - 2021.

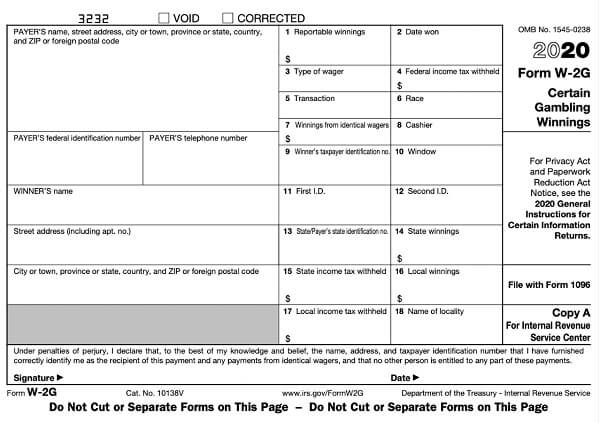

In most cases you list yourself as an individual. So Im basically net -500 but on paypal it says Ive earned 55k. We will withhold federal income tax from the winnings if the winnings minus the wager exceed 5000 and the winnings are at least 300 times the wager.

Learn more about what is reported to the IRS. I did not receive any tax forms from any legit gambling sites. So you havent received your DraftKings tax form in the mail yet AND there is no tax form available in the Document Center.

Sports Betting Tax Tips And Advice From An HR Block Analyst. Tax people say you must report any money as income fantasy football scratch off tickets gambling winnings tips etc. Please advise as to where I input this other income that is not considered gambling however it was gambling winnings.

We should mention that most bettors should have received their DraftKings 1099 forms in the mail after February 1st. Now in terms of loses I have lost 6k in loses with both combined. Well my records were provided by DK itself.

DraftKings at Casino Queen shall use commercially reasonable efforts to process requests for withdrawal within fourteen 14 days of DraftKings at Casino Queens receipt from the user of any tax reporting paperwork or other information reasonably required by DraftKings at. We are regulated by the New Jersey Division of Gaming Enforcement as an Internet gaming operator in accordance with the Casino Control Act NJSA. To find out which states check out our guide to where sports betting is legal.

1 online tax filing solution for self-employed. Based upon IRS Sole Proprietor data as of 2020 tax year 2019. Form W-2G from DraftKings just sharing We will issue a W-2G form each time a player has a payout of 600 or more no reduction for the wagered amount and a return that is 300X the amount wagered.

Based in the UK Ians expertise lies mainly in sports betting and poker and his most memorable win was a 1 eight-fold soccer parlay bet that saw him land a prize of over 2300. Individualsole proprietor C Corp S Corp etc address and social security number. Learn more about the IRSs taxable reporting criteria for gambling winnings and IRS Form W.

Tax Day is right around the corner and sports wagering winnings should be part of a bettors annual filing. To request electronic tax forms via desktop laptop or mobile web. Currently our payroll is handled through Paychex I submit it and I noticed that our state tax ID number was missing.

Tap your profile photo in the top left corner. August 13 2021 1644. Draftkings Sportsbook And Casino Pa How To Play And Get 1 500 Free Effective rate is the actual percentage you pay after deductions.

Ian has spent over 30 years enjoying sports betting poker casino gaming and more. Americas 1 tax preparation provider. The information provided on this page doesnt constitute tax advice and DraftKings advises its customers to consult with a professional when preparing their taxes.

Self-Employed defined as a return with a Schedule CC-EZ tax form. In addition some states that allow casinos will charge a higher tax rate on winnings than for other forms of gambling. Forms 1099-MISC and Forms W-2G will become available online prior to the end of February IRS extended due date.

In fact the only thing he enjoys more than playing is writing. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. Fantasy app customers can change their IRS Form W-9 via desktop laptop or mobile web.

Based in the UK Ians expertise lies mainly in sports betting and poker and his most memorable win was a 1 eight-fold soccer parlay bet that saw him land a prize of over 2300. The tax code is not clear due to the infancy of legal on-line gambling. Andor appropriate tax forms and forms of identification including but not limited to a Drivers License Proof of Residence andor any information relating to paymentdeposit accounts as reasonably requested by DraftKings in.

US Gets A Trio Of F1. Draftkings tax form canada. If there is a difference you would likely have to amend your return or dispute it with DraftKings to get them to reissue the correct 1099.

Online sports betting and daily fantasy sports are distinct products and regulated as such. All of it goes straight to paypal. When you fill out the DraftKings or FanDuel W9 form you will be required to submit your full name or business name tax classification ie.

Below Tax Center tap Download Tax Documents. Casino Queen opens DraftKings sportsbook 2 hours. The IRS will be looking for the exact amount of the 1099- MISC from DraftKings.

I appreciate your answer. Ive made 55k from draftkings ans fanduel combined. The mandate in its current form may be in effect only a few weeks more.

Navigate to the DraftKings Tax ID form. The only place I see where a 1099-MISC is applicable is Small Business Self employed which is not what my DRAFTKINGS form is from. This article covers how you get your DraftKings sportsbook tax form in addition to how you fill in your DraftKings tax form.

So basically Im really panicking because I got a 1099k form from paypal. Log into the DraftKings Sportsbook or Casino app. IMPORTANT LEGAL NOTICE REGARDING TERMS OF USE OF DRAFTKINGS SPORTSBOOK AND CASINO IMPORTANT.

It turns out this its much worse than I thought. Betting on the DraftKings Sportsbook is currently only available in certain states. I use draftkings and fanduel.

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13A-16 OR 15D-16 OF THE SECURITIES EXCHANGE ACT OF 1934. To access the Document Center via Sportsbook or Casino app. The primary focus of the piece was on Rhode Island which had passed sports betting with a 51 percent tax rate hoping to receive 1 million a month in revenue.

My works tax situation is screwed.

Draftkings Sportsbook Free Bet Promo Code Apr 2022

Draftkings Sportsbook Promo Code Apr 22 1 000 Free Bet

Draftkings Tax Form 1099 Where To Find It How To Fill

Paying Tax On Your Sports Betting Profits Is Simple Kind Of

Draftkings Sportsbook Colorado A Phenomenal Sports Betting App

Draftkings Sportsbook Indiana App User Guide Promo Code

Fantasy Sports Taxes Sports Betting Taxes Dfs Army

Draftkings Sportsbook App 1 000 Bonus Mobile Android Ios

Draftkings Stock Climbs 9 After Cuomo Pushes For Sports Betting In Ny

How To Pay Taxes On Sports Betting Winnings Bookies Com

Draftkings Ct Promo Code 2022 For 1 050 Bonus

Draftkings Tax Form 1099 Where To Find It How To Fill

Oregon Sports Betting 2022 Updates

Draftkings Sportsbook Ohio The Best Sports Betting App Coming Soon

How To Bet On Golf At Draftkings Sportsbook

Tax Calculator Gambling Winnings Free To Use All States

Draftkings Sportsbook Welcome Bonus Promo Code

Draftkings Ny Sportsbook Promo Code For Up To 1 050

Quick Answer Will Draftkings Sportsbook Send Me A 1099 Cheating Card Game